It’s now been over one year into COVID-19 pandemic, some countries around the world continue to gradually ease restrictions which allows people to return to normal life. However, manufacturing overall is still suffering from the significant impact of the pandemic. In our June article, we talked about the rising cost of raw materials by analyzing key changes in both demand-side and supply-side economics.

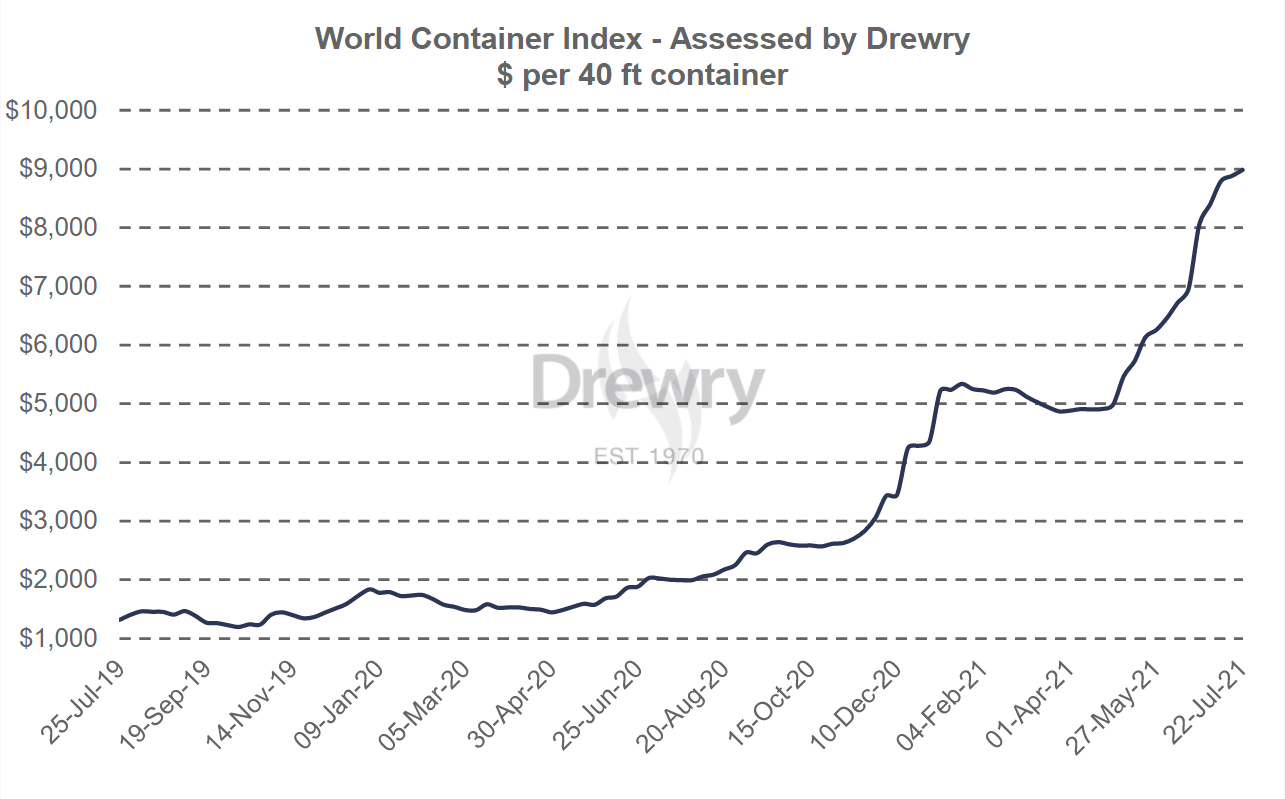

In today’s blog, we will focus on another sign of supply bottlenecks – the skyrocketing shipping cost, driven by the global shortage of shipping containers which begins to blow up in mid-2020. The container shortage has not only led to higher inflation in container prices and shipping cost but also caused serious lead time delays.

Container Prices Continue to Surge

Drewry’s composite World Container index increased 1% or $103 to $8,985.83 per 40ft container which remains 349% higher than a year ago, according to 22 July 2021 update. The measure has surged 64.2% since the first week of May. Listed prices to ship from China to major ports in Europe and the U.S. are between $11,000 and $13,000 per 40ft container. Drewry expects rates to increase further in the coming weeks but at a slower pace. Some companies say they are being charged $20,000 for last-minute agreements to get goods onto outbound vessels.

Credit: Drewry Shipping Consultants Ltd

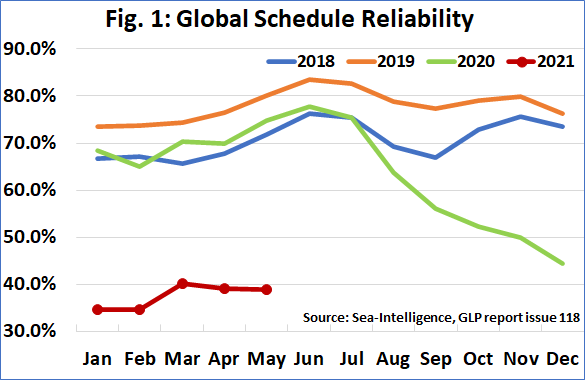

Container Vessel Schedule Reliability Falls to Record Lows

Credit: Sea-Intelligence

When Will the Global Container Shortage End?

Sources:

https://www.drewry.co.uk/supply-chain-advisors/supply-chain-expertise/world-container-index-assessed-by-drewry

https://www.wsj.com/articles/container-ship-prices-skyrocket-as-rush-to-move-goods-picks-up-11625482800

https://www.sea-intelligence.com/press-room/79-schedule-reliability-continues-to-be-low-in-may-2021

https://www.cnbc.com/2021/06/15/china-covid-cases-causing-higher-shipping-costs-delayed-goods.html

256 bit SSL Encryption

256 bit SSL Encryption