With the relaxation of pandemic-induced restrictions across the world, prices of industrial raw materials have continued to skyrocket as surging demand outpaces the global supply.

Apart from that, a number of unforeseen events, including soaring demand for petroleum, shortage of natural gas, China power curb, surging transportation cost and so on, have been causing a severer strain for global supply chain. Here just to name 3 major materials driving up CTi’s production cost the most:

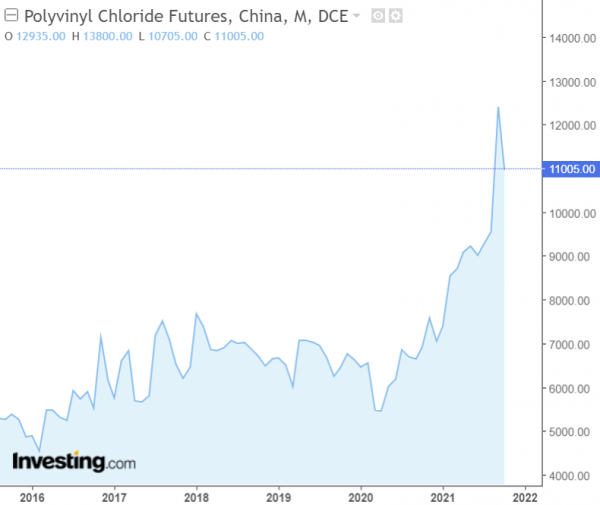

PVC

The recent record high prices of PVC are primarily influenced by the rebound in petroleum demand owing to the reopening of the global economy. What’s more, relatively higher price of natural gas has driven up the usage of petroleum as an alternative to the industrial market.

Besides, owing to the China’s dual control of energy consumption policy (limiting the local coal supply), the recent power shortage across the country has severe impact on the upstream PVC manufacturers’ capacity.

Last but not least, Hurricane Ida damaging the US oil infrastructures as well as the recent explosion at the Westlake Chemical plant well explain why the PVC index reached record high as below.

EVA

The above-mentioned main factors for PVC also pushed the price of EVA, known as main material for LSZH jacket, to the unprecedented level.

Since EVA is one of the raw materials for solar panels and shoes, expanding installation of solar panels in China and escalating demand from the shoe industry in southeast Asia stimulate the surge of EVA prices as shown in below graph

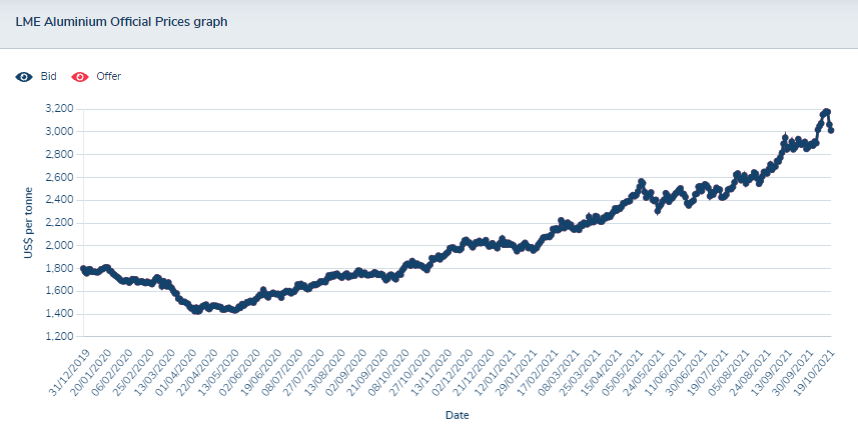

Aluminum

According to London Metal Exchange (LME), the price for aluminum has been rising dramatically since 2021. Similar to PVC and EVA, the production of aluminum was affected by China’s dual control of energy consumption policy as well.

Having said that, more reasons, such as ports closure in Guinea, one of the major bauxite (aluminum)-supplying countries in the world, and Russian’s implementation of 15% export duties on aluminum material, also pushed the aluminum price to the new highs.

Reference links:

https://www.investing.com/commodities/pvc-com-futures-streaming-chart

https://fubon-ebrokerdj.fbs.com.tw/z/ze/zeq/zeqa_D0130890.djhtm

https://www.lme.com/Metals/Non-ferrous/LME-Aluminium#Price+graphs

https://www.thetimes.co.uk/article/brent-crude-oil-prices-top-84-a-barrel-in-energy-crisis-50q9rwgh5

https://www.bbc.com/news/business-58727437

https://edition.cnn.com/2021/09/06/investing/aluminum-prices-guinea/index.html

https://realnoevremya.com/articles/5803-guinea-coup-inflate-aluminum-prices-what-awaits-russian-consumers

https://www.reuters.com/world/china/chinas-power-woes-may-worsen-demand-surges-amid-coal-supply-lag-2021-10-18/

256 bit SSL Encryption

256 bit SSL Encryption