How things have changed with the rising geopolitical tensions since February 2022? Russia’s invasion of Ukraine has dealt a serious blow to the global economy—weakening the post-pandemic recovery, aggravating the already-high inflation and more.

With the escalatory energy sanctions imposed by United States and its allies on Russia, the global supply chain is now again facing significant headwinds from much higher raw material and energy prices. From a cable manufacturer’s standpoint, we would like to elaborate on the impact on crude oil, which has its price being kept at a high level since early 2022.

Crude Oil

Russia is one of the biggest exporters of oil and natural gas, and most European countries are highly dependent on Russia’s energy supply. Following the EU’s plan to impose embargo on Russian crude oil, the oil price inevitably starts to go up.

In addition, due to the substitution effect between oil and natural gas, any decrease from Russia’s natural gas supply to Europe will also result in the rise in oil price, and vice versa. Growing public anticipation of an end to China’s COVID lockdown in Shanghai could also boost oil demand recovery.

Owing to the above factors, the crude oil price soared to an average of $110 per barrel for the past few months, much higher than the annual average price of just $70.68 in 2021. With the US dollar remaining strong and nearing a decade high, the crude price is expected to remain at a high level and continue to drive up the price of relevant petrochemicals such as PVC, PE and PP which are all commonly used for cable sheath and insulation.

Reference links:

https://www.investing.com/commodities/crude-oil https://www.investing.com/commodities/pvc-com-futures-streaming-chart https://www.investing.com/commodities/natural-gas https://www.washingtonpost.com/world/2022/05/04/eu-russia-oil-phaseout-ukraine/ https://www.cnet.com/personal-finance/gas-prices-will-pass-6-a-gallon-this-summer-analysts-predict-when-will-they-hit-the-brakes/ https://www.cmegroup.com/education/articles-and-reports/are-crude-oil-natural-gas-prices-linked.html https://www.reuters.com/business/energy/oil-falls-uncertainty-over-russian-energy-embargo-by-eu-2022-05-11/ https://finance.yahoo.com/news/global-ethylene-vinyl-acetate-eva-102300789.html https://fubon-ebrokerdj.fbs.com.tw/z/ze/zeq/zeqa_D0130890.djhtm

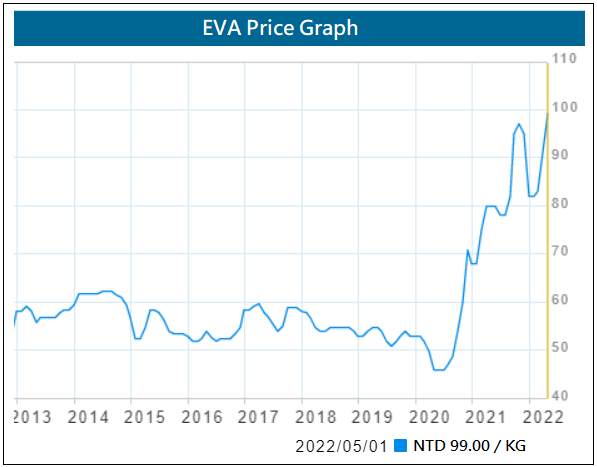

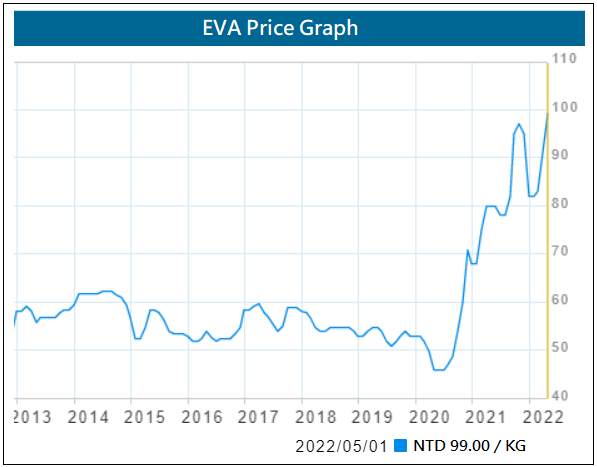

EVA

EVA (ethylene vinyl acetate) is one of the most critical materials for the making of solar panels, shoes, cable jacket and sheath.

As pressure from rising oil and gas price continues to intensify, renewable energy such as solar power gains popularity as an optimal alternative. Expanding demand for solar panels has significantly attributed to the recent record-high EVA price.

Another main driver for the surging EVA price comes from the shoe industry, led by factories in south and southeast Asia resuming and ramping up production during post-pandemic time.

Reference links:

https://www.investing.com/commodities/crude-oil https://www.investing.com/commodities/pvc-com-futures-streaming-chart https://www.investing.com/commodities/natural-gas https://www.washingtonpost.com/world/2022/05/04/eu-russia-oil-phaseout-ukraine/ https://www.cnet.com/personal-finance/gas-prices-will-pass-6-a-gallon-this-summer-analysts-predict-when-will-they-hit-the-brakes/ https://www.cmegroup.com/education/articles-and-reports/are-crude-oil-natural-gas-prices-linked.html https://www.reuters.com/business/energy/oil-falls-uncertainty-over-russian-energy-embargo-by-eu-2022-05-11/ https://finance.yahoo.com/news/global-ethylene-vinyl-acetate-eva-102300789.html https://fubon-ebrokerdj.fbs.com.tw/z/ze/zeq/zeqa_D0130890.djhtm

256 bit SSL Encryption

256 bit SSL Encryption