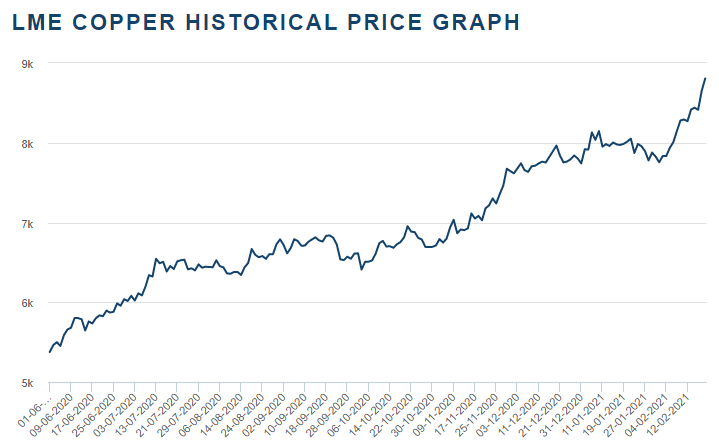

Starting from 2020, the price of copper has steadily increased quarter by quarter, from LME average of 5,500 (USD/metric ton) during June,2020 to nearly 9,000 as of now. Chinese imports and supply threats are the main factors behind this historical surge, which could reach 10,000 by 2021 Q4.

Aside from a weaker dollar, because COVID-19 caused China to halt its economic activity briefly, when factories continued to resume work, demand for copper instantly took off, with China being accountable for roughly 50% of global demand.

South America copper-exporting countries (ex: Chile, Peru), were also a recipient of this pandemic, which came at a time when numerous mine unions were renegotiating their CBAs. While operations aren’t totally paralyzed, workers may still fall victim to COVID, causing mines to cut the workforce over time. Due to the factors above, some mines are close to facing strikes or forced to propose new wage offers to active workers. For example, Peru, the world’s no.2 producer, has reportedly suffered a 40% decrease in output at May.

Experts have also stated that supply threats will be the main driver for copper price going forward, with forecasts estimating LME copper to climb between the range of 9,500 to 10,000 by 2021 Q4.

Reference links:

https://www.lme.com/en-GB/Metals/Non-ferrous/Copper#tabIndex=2

https://www.mining.com/web/labor-tensions-add-to-coppers-steady-drumbeat-of-supply-threats/

https://www.hellenicshippingnews.com/copper-price-to-rise-in-2021-analysts/

https://www.mining.com/copper-price-near-2-year-high-after-chinese-imports-rocket/

https://resource-recycling.com/e-scrap/2020/12/10/copper-prices-approach-eight-year-high/

https://www.lme.com/en-GB/Metals/Non-ferrous/Copper#tabIndex=2

https://www.mining.com/web/labor-tensions-add-to-coppers-steady-drumbeat-of-supply-threats/

https://www.hellenicshippingnews.com/copper-price-to-rise-in-2021-analysts/

https://www.mining.com/copper-price-near-2-year-high-after-chinese-imports-rocket/

https://resource-recycling.com/e-scrap/2020/12/10/copper-prices-approach-eight-year-high/

256 bit SSL Encryption

256 bit SSL Encryption