The shortage in the supply of feedstock due to closing of facilities during the lockdown and the rising demand from construction have pushed PVC prices to new highs. Another major factor driving the growth of the market is the rising usage of PVC from the automotive industry. PVC price has reached over $1,000/mt in Q4 2020 starting from $700/mt in May 2020.

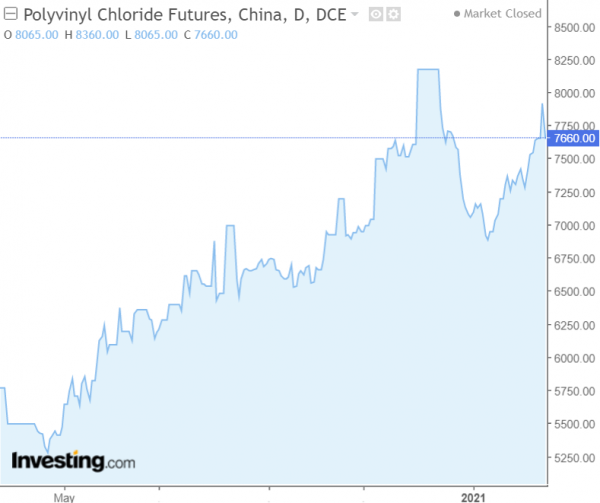

After the price rebound in May, DCE PVC Futures price has been continuously increasing, from $6,000/mt during June 2020 to around $7,600/mt by now.

Demand improved in Asia as downstream construction and manufacturing activity slowly recovered from the coronavirus pandemic. Restocking activities remained buoyant in Asia, as tight global supply meant that many buyers who held off purchasing at the height of the pandemic earlier in the year were unable to build adequate inventories and subsequently had to restock.

European PVC supply tightened as global prices reached record levels, which encouraged exports by domestic producers and made imports mostly not feasible. European PVC demand was stable to higher compared with Q3, as December demand was above average and high global prices spurred additional buying. While demand saw a dip during the holiday season, market sources saw higher activity than usual because of mild weather, with buyers and sellers making up for time lost earlier in the year and amid concerns of further price increases.

Supply in the US slowly increased from an October low point as two major producers declared force majeure: one the result of hurricane damage and the other suffering technical issues in an upstream plant. PVC demand remained firm in both the domestic market and for exports well into what is the usual season of demand lull. US construction activity remained strong and demand for pipe grade material also remained firm.

Reference links:

https://www.spglobal.com/platts/en/market-insights/latest-news/petrochemicals/091820-feature-tight-global-pvc-supply-pushes-prices-to-multi-year-highs

https://www.icis.com/explore/commodities/chemicals/polyvinyl-chloride/

https://www.investing.com/commodities/pvc-com-futures-streaming-chart

256 bit SSL Encryption

256 bit SSL Encryption